Today everyone, especially young people, work hard day and night to live a good and comfortable life. If we talk about savings, they will say that they save 20-30 of the monthly income and they are very happy about this. If you save 20-30 percent of your income and are satisfied with it, then we tell you a game. Imagine that you have put all your savings in a boxe. After your retirement.

Now open your box and see what you have got. Also include 6 percent inflation in this entire calculation. You will get some amount as a retirement fund. Now see how you are going to manage your post-retirement expenses. Did you get what you thought? No no You must have understood that such savings are not enough to live a normal life. So where did you make a mistake? How is this big difference in your retirement funds?

You did not consider the inflation rate at the time of saving.In India inflation rate is 6-7%, it means if your money is idle for years means you are losing 6-7 % every year. That’s why investment to counter inflation and create wealth.

Saving:

The difference between your monthly income and expenses is called saving. Add all your expenses like food, luxury, school fees, med fees, drivers, rent, bills, maintenance and everything. What will be left is your savings.

Control your expenses for savings:

Pay attention to your expenses and control them. You can control expenses by limiting credit card usage, paying bills on time and adopting the right resources. Eliminate unnecessary expenses, this will increase your savings. If you invest more than your savings, then you will get good returns going forward.

It is important to track your savings, putting a deadline, or timeline, and a value to your goals. For example, if you are saving for your annual tour, you might want to target some money to save in some months to withdraw at the time of tour.

Investing:

Investing means increasing your saved money to grow, such as investing in fixed deposits, stock markets, mutual funds and other investment options.

Why Investment Needed.

After an age you feel that the money you have is not enough, you may need more money in future. In such a situation, you take the path of investment.

Initially, everyone is nervous about investing, but later when the understanding increases, then the investment process starts to get better. The truth is that if you are so big that you can earn money, then you should also invest money. Investing is not really anything but a process whereby you can use your money.

No person wants to work for a lifetime. This is also a major reason that you should invest your money so that your future can be secured. Whatever your goal is to send children abroad for higher education or to spend your retirement time by the sea, investing properly can help you achieve your financial goals.

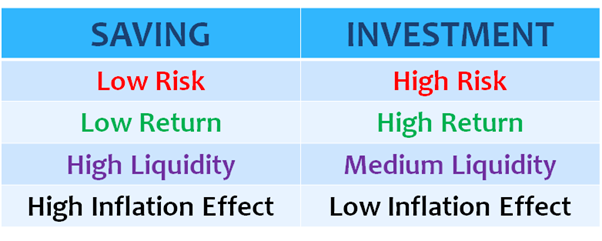

Saving is not Investment.

Assume you have a son who wants to become a doctor in the next 15 years. In today’s situation, you need at least 50-60 lakh rupees for medical studies. Therefore, you have to save about 4 lakhs every year to fulfill your son’s gesture. Okay, you will probably save this amount as well. Do you know how much money your son needs in the next 15 years for medical studies?

About 1.0 crore rupees. You can also add 6 percent inflation only then you will be able to calculate the right. Merely saving a certain amount every month or every year will not fulfill your future objective.

Unlike saving, when you invest your money, you do not just keep it safe but try to increase it. Saving money in a bank account cannot be called investing.

I hope that you have got knowledge of all the things related to Saving & Investing.

Wish you best for your Investment Journey.

Jazakallah Khair

Add Comment